WASDE Shows Decrease in US Corn and Soybeans Ending Stocks in 2024/2025

Author

Published

1/13/2025

Introduction

The USDA released its updated WASDE report on January 10, 2025.

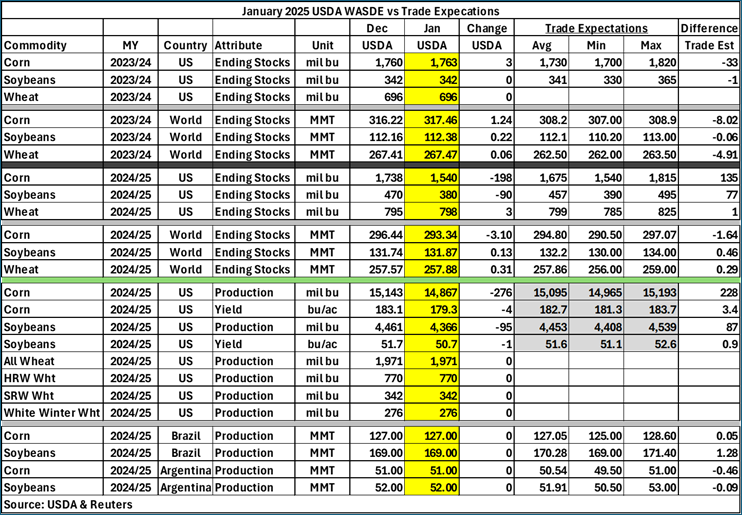

USDA adjusted last year’s US corn ending stocks by increasing them 3 million bushels while soybean and wheat ending stocks remain unchanged for the 2023/2024 marketing year. US corn ending stocks for the 2024/2025 marketing year are 1,540 million bushels (mb), 198 mb less than the December WASDE and 135 mb less than trade expectations. Soybean ending stocks for the 2024/2025 marketing year fell 90 mb from the December WASDE and were 77 mb short of trade expectations. Wheat ending stocks increased by 3 mb to 798 mb, and were just 1 mil/bu shy of trade expectations for the 2024/2025 marketing year.

World ending stocks for corn, soybeans, and wheat for the 2023/2024 marketing year all saw small increases from December to January. However, for the current 2024/2025 marketing year, world corn ending stocks decreased by more than 3 mil/bu, while soybean and wheat ending stocks increased slightly.

Table 1 shows some key report estimates along with trade analyst expectations.

Table 1. November 2024 USDA WASDE vs Market Expectations

For 2024, US corn and soybean production decreased by 276 and 95 mil/bu respectively. U.S. national yield per acre decreased by 4 and 1 bushels per acre for corn and soybeans, respectively. US wheat production across all classes remained constant.

World corn, soybean, and wheat ending stocks increased by 1.24, 0.22, 0.06 MMT respectively for the 2023/2024 marketing year. World corn ending stocks decreased by 3.10 MMT. World soybean and wheat ending stocks decreased by 0.13 and 0.31 MMT for the 2024/2025 marketing year.

The USDA’s Brazil and Argentina corn and soybean production estimates remain unchanged from December to January.

Initial Market Reaction

The immediate market reaction to the USDA reports saw corn prices quickly increase by 10 cents to $4.67 and peak at $4.72 15 minutes after the January WASDE released. The March corn futures price increased by 10 cents immediately and the May corn futures price increased by 15 cents. At the close of trading, March corn was up 15 cents per bushel to $4.71 and new crop December 2025 corn futures were up 2.5 cents per bushel at $4.495. March 2025 soybean futures increased by 33 cents per bushel to $10.32 within minutes of the WASDE release, then settled back and closed at $10.26, up 27.5 cents for the day. The May soybean futures price followed a similar trend with May futures increasing by 28 cents at the close. November 2025 soybeans trades as much as 25 cents higher on the day and closed 17 cents higher. Wheat prices increased and decreased multiple times within the first 30 minutes of the WASDE’s release, with the March 2025 wheat contract peaking at $5.41 before settling 3.25 cents lower on the day at $5.3075 per bushel. March soybean meal prices spiked after the report to $305/ton, then fell back and closed $1/ton lower on the day at $298.30per ton. Soybean oil initially moved moderately higher, but then increased the rest of the session and closed near the highs with March 2025 soybean oil closing up by 2.82 cents per pound at 45.58 per pound.

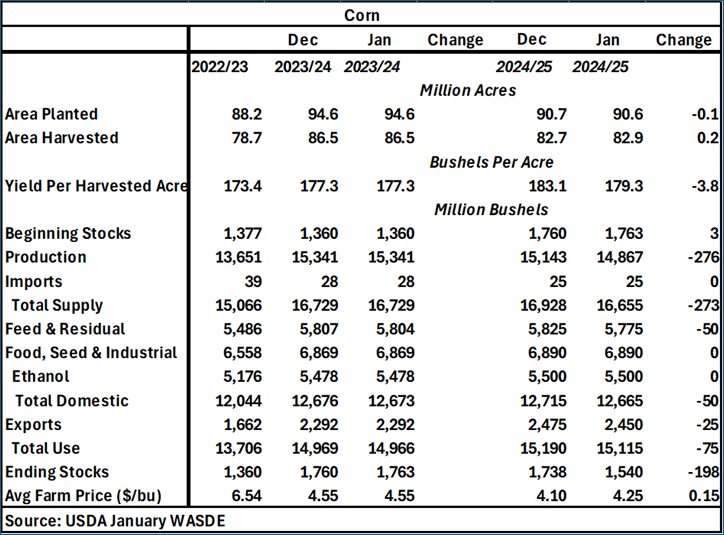

Changes to Domestic Balance Sheets

For corn, there was a 3 mb decrease in feed use which resulted in a 3 mb increase in ending stocks for 2023/2024. For the 2024/2025 marketing year balance sheet, area planted and yield per harvested acre slightly decreased by 0.1 million acres and 3.8 bu/ac respectively. Area harvested increased by 0.2 million acres. Final estimates for 2024 revealed corn yields to be 179.3 bu/ac and production at 14,867 mb. On the supply side of the balance sheet, production decreased by 276 mb, beginning stocks increased by 3 mb, and imports stayed constant, leading to total supply decreasing by 273 mb to 16,655 mb. On the demand side, feed and residual decreased by 50 mb while food, seed, and industrial stayed constant, leading to 50 mb reduction in total domestic use. Total use decreased by 75 mb due to the reduction in total domestic and exports decreasing 25 mb. Corn ending stocks decreased by 198 mb from December to January. Expected average farm prices continue to remain unchanged for 2023/2024 and increased from $4.10 to $4.25 for 2024/2025.

Table 2. January 2024 WASDE Corn Balance Sheet

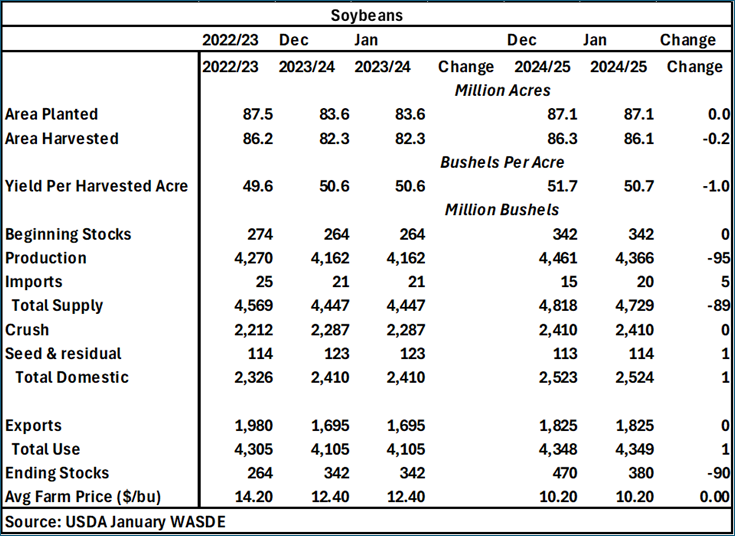

For soybeans, there were no changes in the 2023/2024 balance sheet. The final estimates of 2024 soybean yield and production were 50.7 bushels per acre and 4,366 mb respectively. Area harvested decreased by 0.2 million acres from December to January. On the supply side production decreased by 95 mb and imports increased by 5 mb, leading to an 89 mb decrease when accounting for rounding changes. On the demand side of the soybean balance sheet, seed and residual increased by 1 mb leading to the same increase in total domestic. No changes in exports means total use increases by 1 mb. Soybean ending stocks decreased by 90 mb from 470 to 380. Average farm price remained constant at $10.20.

Table 3. January 2024 WASDE Soybean Balance Sheet

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!