Soybean Crush Product Prices Switch Again

Author

Published

2/19/2023

Soybean Crush Product Prices Switch Again

Argentina Drought Contributes to Moving Soy Complex Prices

The drought in Argentina has flip-flopped soybean oil-soybean meal values again (Figure 1). Historically, soybean oil made up under 40% of the total crush value. However, policy efforts to lower carbon emissions have indirectly made soybean oil more valuable as a feedstock for renewable diesel.

But even though soybean oil demand remains strong in the US, its price has weakened over the past few months while soybean meal prices have increased (Figure 2). This has been a result of the drought in Argentina.

Figure 1. Relative Value of Soy Crush Products

Figure 2. Comparison of Soybean Oil and Soybean Meal March 2023 Futures Prices

Argentina a major producer of soybeans but also has large soybean crush capacity. Reports have begun to suggests Argentina is importing soybeans from Brazil, another large soybean producer, to keep their processors at capacity. Furthermore, other markets like European region which typically import and process whole beans from Brazil now face increased competition for soybeans.

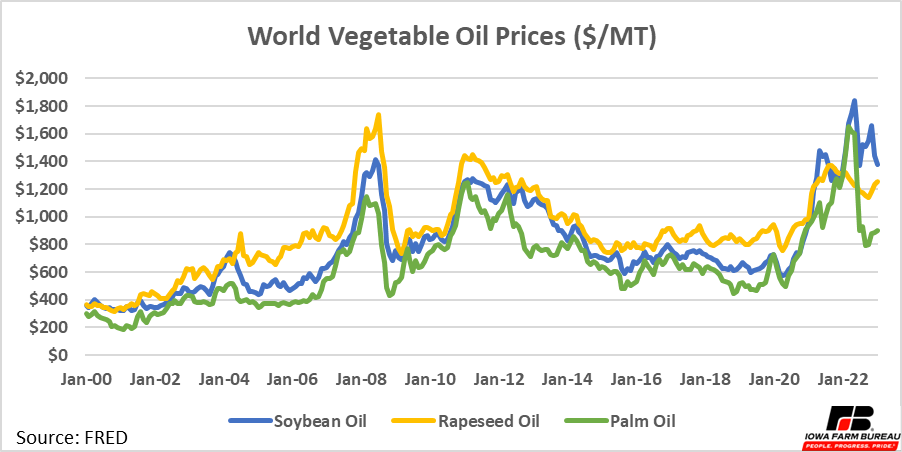

Other markets can access palm oil or canola oil as substitutes for soybean oil. Both prices are currently lower than soybean oil prices on the global market, so if substituting these other oils is possible, this is likely to occur in markets looking to import vegetable oil (Figure 3). Collectively this puts downward pressure on soybean oil prices.

Figure 3. World Vegetable Oil Prices ($/MT)

While soybean oil has substitutes available on the world market, it is difficult to find the same quantities of a suitable soybean meal substitute. These other markets still need soybean meal and the increased demand from these markets is increasing global soybean meal prices.

Soybean Oil Still Higher Than Other Vegetable Oils

US policy still looks to be supportive of soybean oil prices long term. As mentioned above, strong incentives for lower carbon fuel have increased US renewable diesel capacity tremendously. Renewable diesel has a relatively lower carbon intensity score, and soybean oil is one of the primary feedstocks used in renewable diesel production. EIA reports annual US renewable diesel production capacity was 2.67 billion gallons in November 2022, which is a 141% increase year-over-year. A discussion of renewable diesel policy incentives is available here.

But the renewable diesel boom may also be keeping soybean oil prices higher right now. Looking back at Figure 3, notice the gap between soybean oil and palm oil is as high as it has every been. Also, rapeseed/canola oil is typically more expensive than soybean oil, but that has not been the case as of late. The relationship between the two prices appears to be changing.

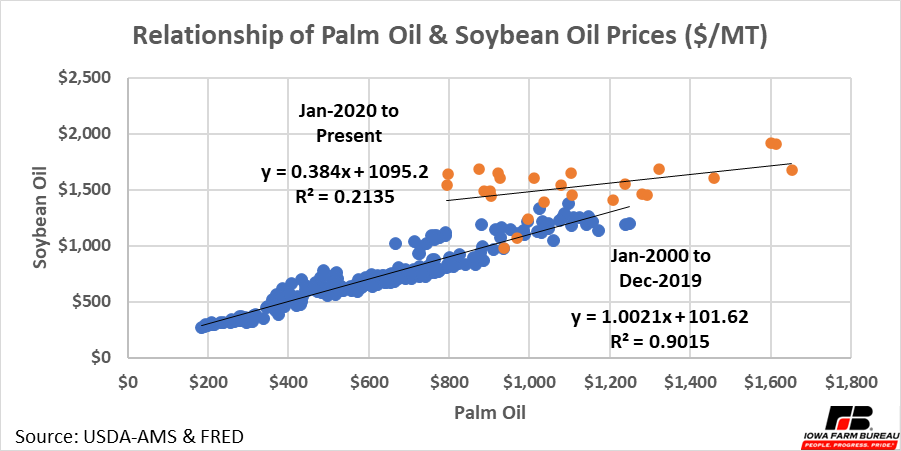

The change in these relationships is easier to see in Figure 4 and Figure 5. In the last two years the price of soybean oil has been higher relative to the other major oils and the correlation between the price of soybean oil and other oils has been lower than it was in the past. Over the same period, renewable diesel production has also taken off in the US. It is possible demand for soybean oil from the US renewable diesel industry is keeping soybean oil prices higher relative to these other vegetable oils.

Figure 4. Relationship of Palm Oil and Soybean Oil Prices ($/MT)

Figure 5. Relationship of Rapeseed Oil and Soybean Oil Prices ($/MT)

Conclusion

Despite continued strong domestic demand for soybean oil, global factors, specifically the drought in Argentina has pushed soybean oil prices lower. Look for other vegetable oil prices to increase on the world market and exports of soybean meal from the US and Argentina to increase as well in the short term.

Long term policy in the US still looks to be supportive to soybean oil. In fact, the boom in US renewable diesel production may be one of the factors supporting soybean oil prices while other major vegetable oil prices are lower. Looking ahead, barring any large new demand for soybean meal, soybean oil will likely again supplant soybean meal as the most valuable crush product in the future.x

Economic analysis provided by David Miller, Consulting Chief Economist, and Aaron Gerdts, Research Analyst, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!