September USDA Supply and Demand Updates

Author

Published

9/14/2022

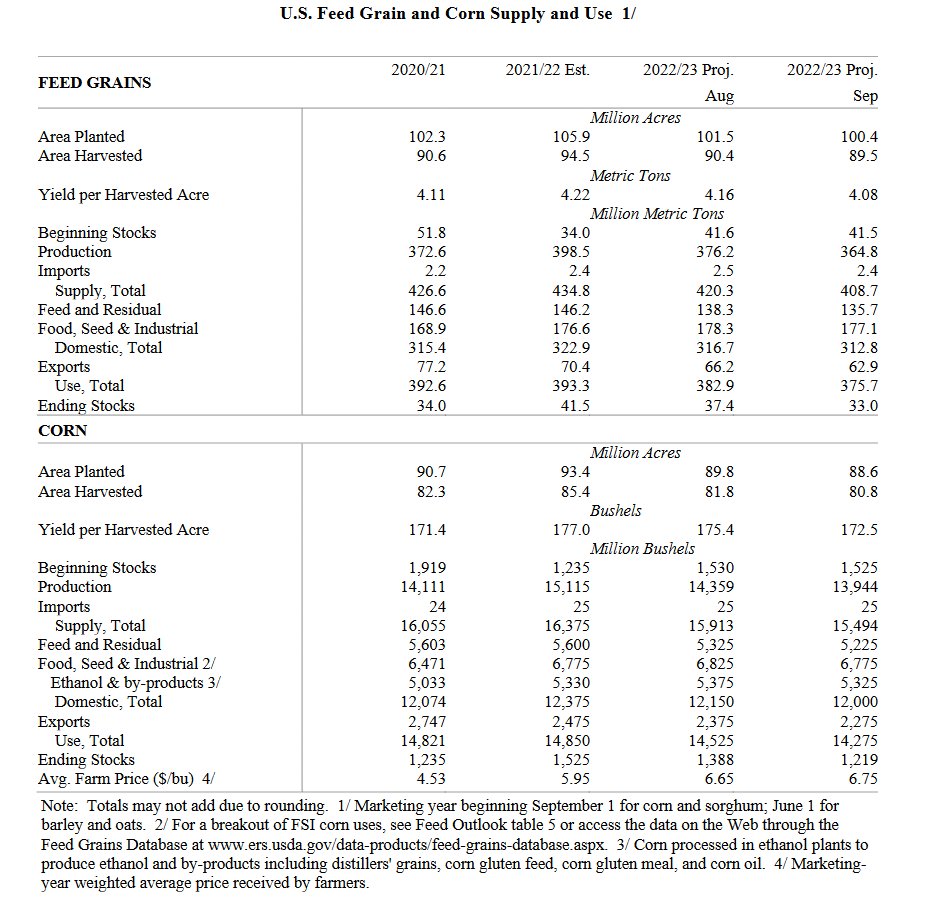

USDA lowered its estimate of coarse grain supplies with decreases in both corn and grain sorghum production. They also lowered their estimates of feed use, corn use for ethanol and exports of corn and grain sorghum and reduced ending stocks for both corn and grain sorghum compared to last month’s estimates. Smaller supplies, especially in the western Cornbelt and the southern Plains states should lead to relatively stronger basis levels as those areas will need to keep corn flowing for cattle feeding and other uses.

The national average yield is forecast at 172.5 bushels per acre, down 2.9 bushels. Harvested area for grain is forecast at 80.8 million acres, down 1.0 million. Total U.S. corn use is cut 250 million bushels to 14.3 billion. Feed and residual use is lowered 100 million bushels based on a smaller crop and higher expected prices. Exports are cut 100 million bushels to 2.3 billion while corn used for ethanol is lowered 50 million to 5.3 billion. With supply falling more than use, ending stocks are down 169 million bushels to 1.2 billion. The season-average corn price received by producers is raised 10 cents to $6.75

per bushel.

Major global coarse grain trade changes for 2022/23 include larger corn exports for Ukraine but a reduction for the United States. Corn imports are lowered for Canada and Vietnam. Foreign corn ending stocks are raised 2.2 million tons to 273.6 million, mostly reflecting increases for China and India that are partially offset by declines for Ukraine, the EU, and Thailand. World corn ending stocks at 304.5 million tons, are down 2.2 million.

Total feed and residual use for coarse grains in the U.S. was reduced by 2.6 million metric tons from the August estimate and is now projected to be 10.5 million metric tons less than for last year’s crop. Exports of feedgrains are projected to be down 10.6% compared to a year ago and ending stocks for all feedgrains are projected to be down 20.5% from a year ago.

The corn balance sheet in the September WASDE report reflects lower beginning stocks than a month ago (-5 million bushels), less production than a month ago (-415 million bushels), less feed demand (-100 million bushels), less ethanol processing demand (-50 million bushels), and less exports (-100 million bushels), all of which results in less ending stocks (-169 million bushels) than a month ago and a decline in projected ending stocks for the 2022/23 marketing year that are 306 million bushels less than the 2021/22 marketing year. The net impact on price is an increase in the season average price from $6.65 to $6.75, September compared to August and a gain of $0.80 per bushel compared to last year’s season average marketing year price.

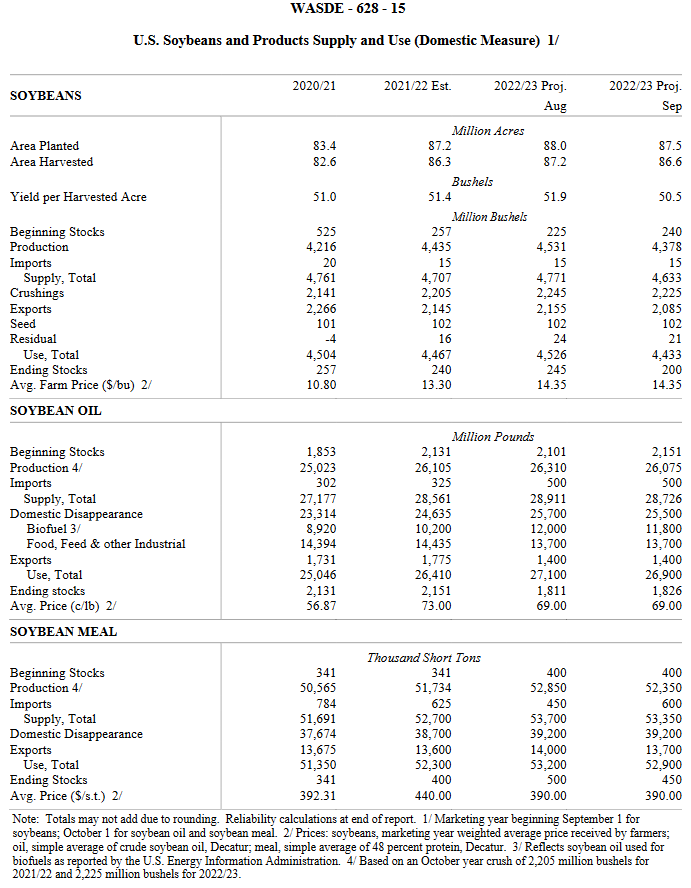

USDA changed the supply and use estimates for soybeans by increasing the beginning stocks by 15 million bushels, lowering production by 153 million bushels, lowering domestic soybean crush by 20 million bushels, lowering exports by 70 million bushels, dropping the residual use by 3 million bushels, all resulting in a drop in projected ending stocks for the 2022/23 marketing year of 45 million bushels. Despite these changes, USDA left the projected season average price of soybeans unchanged from the August estimate of $14.35 per bushel which would be $1.05 per bushel higher than the season average price for the 2021/22 marketing year.

For the soybean products, beginning stocks of soybean oil were increased by 50 million pounds, production of soybean oil decreased by 235 million pounds, biofuel use decreased by 200 million pounds, and ending stocks increased by 15 million pounds. The season average price of soybean oil for 2022/23 was left unchanged from August at 69 cents per pound, down 4 cents per pound from the 2021/22 marketing year.

Soybean meal beginning stocks were left unchanged, production was reduced by 500,000 tons, imports increased by 150,000 tons, and exports reduced by 300,000 tons for a net decrease in projected ending stocks for the 2022/23 marketing year of 50,000 tons. There was no change in the estimated season average price of soybean meal at $390 per ton, which would be $50 per ton less than the season average price of the 2021/22 marketing year.

USDA increased foreign oilseed production by 2.8 million tons mainly due to higher estimates for sunflowerseed and soybean production in Ukraine and higher rapeseed production in Australia. Ukraine’s soybean production is raised on higher area. Rapeseed production for Australia is raised on recent beneficial rainfall improving yield prospects. Higher exports of sunflowerseed and rapeseed from Ukraine and Australia are in line with higher EU imports. EU soybean imports are lowered with higher supplies of other oilseeds. China soybean imports for 2022/23 are lowered 1.0 million tons to 97 million.

Global soybean ending stocks at 98.9 million tons are down 2.5 million mainly on lower U.S. and China stocks.

LIVESTOCK, POULTRY, AND DAIRY

The forecast for 2022 red meat and poultry production is fractionally higher than last month, as higher beef, pork, and broiler forecasts are partly offset by a lower turkey forecast. Beef production is raised for the second half of the year with higher expected slaughter for the period offset slightly by lower expected third-quarter carcass weights. Pork production for the third quarter is raised on a higher-than-expected slaughter pace albeit at slightly lower carcass weights. Broiler production is raised slightly on current slaughter data and higher eggs set and chicks placed. Turkey production is forecast lower based on slaughter to date and hatchery data. Egg production is raised slightly from last month.

For 2023, the red meat and poultry production forecast is raised on higher beef and broiler production. The beef forecast was raised, reflecting higher expected placements in late 2022 which will be marketed in the first half of 2023. Broiler production is raised on higher expected eggs set and chicks placed during the year. Turkey production is lowered slightly, as first quarter production is expected to be close to 2022 levels. The pace of egg production growth for 2022 is expected to carry into early 2023, supporting a higher forecast.

The beef import forecast for 2022 is lowered on July trade data and expectations of slower imports, largely from Oceania during the remainder of the year; the export forecast is unchanged. Beef import and export forecasts for 2023 are unchanged. Pork imports and exports are both lowered for 2022 on recent data. For 2023, pork imports are lowered but the export forecast is unchanged. The broiler export forecast for 2022 is lowered on recent data and expectations of slowing demand in price sensitive markets; the forecast for 2023 is unchanged. Turkey exports are unchanged for 2022 and 2023.

Cattle price forecasts for 2022 are raised on current strength in demand, but forecasts for 2023 are unchanged. The 2022 hog price forecast is lowered on observed prices but is unchanged for 2023. The broiler price forecasts for 2022 and 2023 are lowered on higher forecast production. Turkey price forecasts for 2022 are unchanged, while 2023 prices are raised as a result of the lowered early-year production forecasts. The 2022 egg price forecast is raised as second half prices are expected to be supported by firm demand; as demand strength is expected to continue in early 2023, the first quarter price forecast is also raised.

The milk production forecasts for 2022 and 2023 are lowered from last month. Milk cow numbers are reduced, reflecting the average July 2022 cow number reported in the recent Milk Production report. Slower growth in cow numbers is carried through late 2022 and is expected to carry into 2023. Output-per-cow is forecast to increase at a slightly more rapid pace in 2022 but the forecast for 2023 is unchanged.

Fat and skim-solids basis imports for 2022 and 2023 are raised, largely driven by recent trade data and higher expected imports of cheese throughout the forecast period. Exports for both years are raised on expectations of stronger whey, lactose, and cheese exports, which are projected to be price competitive.

For 2022, forecasts for butter prices and nonfat dry milk (NDM) are raised slightly on current price strength, but cheese and whey prices are unchanged. Both Class III and Class IV prices are raised, reflecting changes in their component values. For 2023, forecasts for butter and NDM are raised on tighter supplies, cheese is lowered slightly, while whey prices are unchanged. The Class III price is unchanged while the Class IV price forecast is raised on higher butter prices. The 2022 all milk price forecast is raised to $25.45 per cwt and the 2023 all milk price is raised to $22.70 per cwt.

Economic analysis provided by David Miller, Consulting Chief Economist, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!