Renewable diesel holds promising potential

Author

Published

7/17/2023

Made from soybeans (as well as canola oil, corn oil, animal fats and used cooking oil), renewable diesel is drawing a lot of attention in the renewable fuels market.

Unlike biodiesel, which is normally blended with petroleum diesel, renewable diesel uses hydrotreating to create a “drop-in” fuel that can be used as a complete replacement for petroleum diesel.

Biodiesel plants tend to be located near soybean production areas. Renewable diesel plants tend to be located near oil refineries, and production led by traditional petroleum companies.

“They understand the process, and they are responding to investors and consumers as they desire to get more into the green fuels space,” says Scott Gerlt, chief economist with the American Soybean Association (ASA), who discussed renewable diesel in a recent webinar hosted by the Iowa Farm Bureau.

Overall, the renewable energy market has expanded greatly in the past couple of years. Renewable diesel capacity has grown from less than 1 billion gallons at the beginning of 2021, to 3.5 billion in 2023.

“That’s the fuel that is taking off and driving growth,” says Gerlt.

Another 3.5 billion gallon renewable diesel capacity is in planning stages. “But announcements aren’t shovels in the ground,” says Gerlt. “Even under the best scenarios, not all of these plants will happen.”

The planned crushing facilities alone would increase soybean oil supplies by about 5.5 billion pounds, translating into around 700 million gallons of renewable diesel.

Renewable aviation fuel is also part of the picture, although a minor part as of now. Production is similar to renewable diesel with more treatment required. “It is costly to produce, and the economics just aren’t there yet,” says Gerlt.

A market driven by policy

Gerlt cites three policies that affect biomass-based diesel (BBD): national blending levels, a national tax credit and state policies that incentivize renewable diesel and biodiesel.

The Blenders Tax Credit is a $1 per gallon tax credit currently paid to blenders. That is set to transition to payment to producers in 2025. The credit amounts will depend on the carbon intensity of the fuel and will only be available for domestic production. The credits are currently set to expire at the end of 2027.

One of the most notable state regulations is California’s Low Carbon Fuel Standard (LCFS). Nearly all renewable diesel is sent to and used in California, with other states starting to implement similar rules.

Under the LCFS, a fuel generates credits according to its carbon intensity reduction, with more credits for by-products such as used cooking oil, animal fat and distillers corn oil than soy and canola oil. By-products are scored in California as having no land use change or industry adjustment, but also offer little room for growth, whereas soy and canola can be scaled to meet demand.

Underestimating growth

National blending levels, or renewable volume obligations (RVO), are set through the Renewable Fuel Standard.

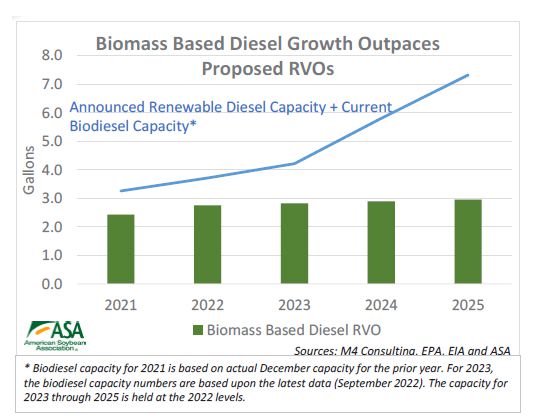

Gerlt and other industry experts are concerned the Environmental Protection Agency is underestimating industry growth in setting RVO levels, a move that could have negative impacts.

“While not all announcements will come to fruition, we are in the midst of very significant, very historic expansion,” says Gerlt. “We’re already seeing billions of dollars in investment. If the blending levels aren’t there, it could halt expansion.”

Much of the planned expansion is in soybean crushing capacity, with 20 new or expanding plants, mostly in the Midwest, projected to increase domestic crushing capacity by 30%. Additional crushing also provides additional soymeal for livestock production.

The EPA issued its final rule through 2025 in June, setting RVO levels much lower than hoped.

“It’s about a three-fold increase,” says Gerlt. “But that’s not hard when you start low.” Industry supporters had hoped for an increase that better matched planned capacity.

“With what we have on track yet this year, we will already exceed 2025 requirements,” says Gerlt. “That means a lot of gallons are looking for a home. We’re over producing already.”

Gerlt says with the new RVO levels not supportive of growth, some plants still on the drawing board will not be completed. “If they haven’t started building yet, there are likely some serious conversations going on,” he said.

The EPA acknowledges renewable diesel is expanding, but questions if there will be the needed feedstocks, says Gerlt.

The ASA provided information to the agency that showed the potential for the 700 million gallons of renewable diesel that could be produced over the next three years from the announced crush expansion.

The ASA said soybean production has the potential to grow with expected increases in trend yields of 0.6 bushels or more per year, and additional soybean acres picked up through crop rotation. And Gerlt says with about half of the nation’s whole soybeans exported, some decrease there could be absorbed without major disruptions. None of ASA’s models involve deforestation or major land use shifts.

Fears of increasing food prices during a time of high inflation may have influenced EPA’s decision.

But ASA models show use of soybean oil for biofuels has almost no net impact on food price inflation.

Oil accounts for 20% of the soybean, and less crushing means not only less oil, but less meal by-product.

“An abundant supply of meal helps lower meat prices, which balances consumer costs,” says Gerlt. “You really have to look at everything. Soybeans aren’t just one product.”

The new EPA rule also includes some technical changes that Gerlt says will be helpful and legislation has been proposed that could alter the picture.

“This is a policy driven market, and these are just some of the headwinds facing increased biofuel production,” says Gerlt. “The will to grow is there, if policy backs it up.”

The renewable diesel webinar can be viewed by Farm Bureau members on the Iowa Farm Bureau website at tinyurl.com/2p8d7hap.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!