Mississippi River Flooding Update

Author

Published

5/15/2023

Upper Mississippi Closure May Affect Fertilizer Shipments More than Grain Shipments

The Upper Mississippi River is rising due to snowmelt in Northern states. Figure 1 shows river levels across the US. Purple, red, and orange dots represent gauges along rivers where flooding is a concern, with purple dots indicating the highest level of concern. Notice the Upper Mississippi on Iowa’s eastern edge is almost all purple, indicating flooding.

Figure 1. NOAA NWS River Level Forecasts, 5/1/2023

As a result of high waters the USDA reported last week that all locks and dams north of Lock 17 (near Boston, IL) were closed and are expected to stay closed for the next three weeks. The USDA also noted locks and dams as far south as Lock 22 (near Saverton, MO) may need to close in the next week due to high water moving down the river.

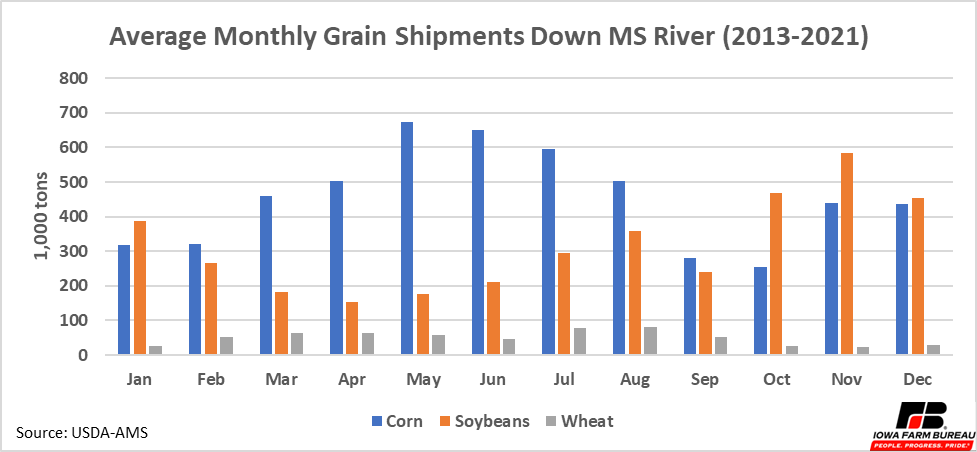

Ordinarily this could spell trouble for US grain shipments. Figure 2 shows the average grain shipments down the Mississippi river by month for corn, soybeans, and wheat from 2013 to 2021. Historically, a lot of corn moves down the river during May.

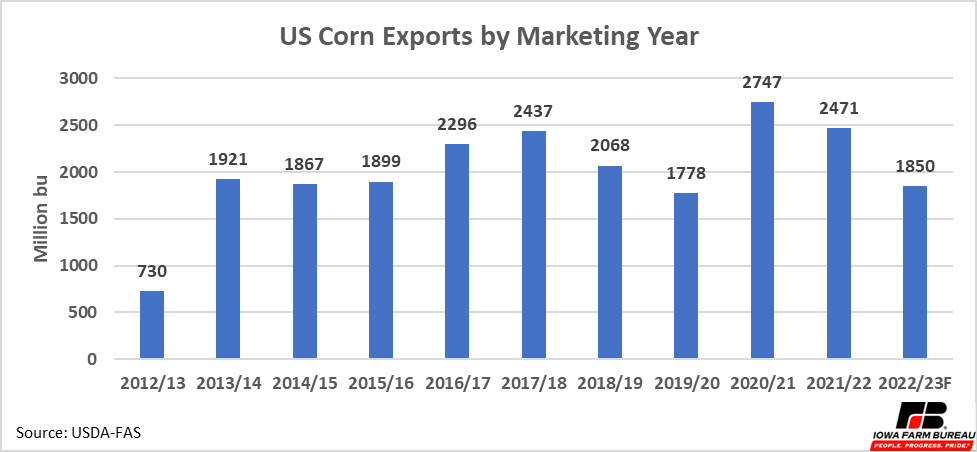

However, this will not be much of an issue this year as export sales have been slow all year. The US is forecast to export 1,850 million bushel of corn this year, well below levels the last two years and below most years reaching back to 2013 (Figure 3). Corn export sales so far look to have a hard time reaching the current forecast. The foreign demand for US corn has not been strong all year and there is no expectation that will change in the coming weeks.

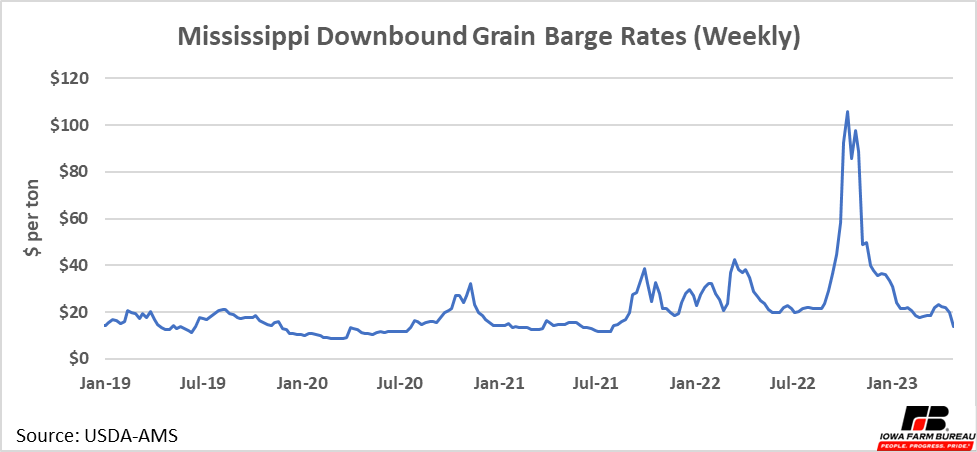

Further evidence of low foreign demand is apparent in barge rates. After hitting highs last fall when low river levels prevented travel, barge rates have fallen dramatically. This is because there is not enough demand for barges to support higher exports.

Figure 2. Average Monthly Grain Shipments Down MS River (Tons)

Figure 3. US Corn Exports by Marketing Year

Figure 4. Mississippi Downbound grain Barge Rates (Weekly)

Both the low accumulated corn exports and current low barge rates point to low foreign demand for corn. Therefore, the inability to move corn down the river for a few weeks is not a large concern for the time being. However, the inability to move fertilizer up the river may have an impact on agriculture in the Upper Mississippi watershed.

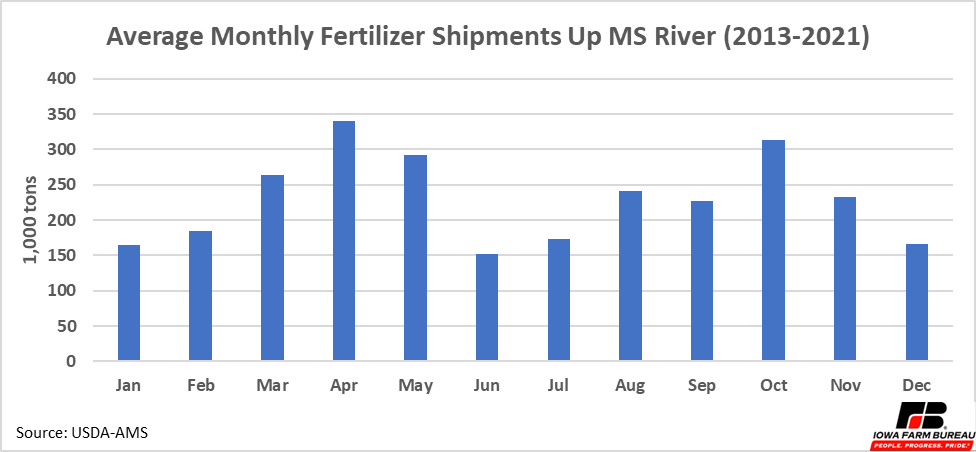

Figure 4 shows average monthly fertilizer shipments upstream from 2013-2022. A large amount of fertilizer is typically moved up the river in April and May. It is unlikely this is fertilizer that will to be applied at planting, as many farmers and ag retailers would have already received that product by now. This could include fertilizer to be applied later this spring or be product to restock inventories for this coming fall. If the river is closed for a long period of time ag retailers may need to resort to other, more expensive shipping modes, like truck or rail. This could increase fertilizer prices in the short term if more costly transportation methods are needed to move the product.

Figure 5. Average Monthly Fertilizer Shipments Up MS River

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!