June 2024 WASDE Recap

Author

Published

6/17/2024

Introduction

The USDA released its updated WASDE report on June 12, 2024. The focus of the June report is typically on wheat as harvest has already begun and on lingering changes in world production and ending stocks. This year is no different. There were no changes in the U.S. supply and demand balance sheet for corn and only a minimal change for 2024/25 soybeans (beginning stocks increased 10 million bushels and ending stocks increased 10 million bushels).

More of the focus of this report was on the production estimates for Brazil and Argentina and potential changes on world ending stocks. With the very large gap between USDA and Brazilian-based estimates of South American corn and soybean production, traders are looking to see how that gap will be resolved. USDA left corn production estimates unchanged from the May estimates for both Brazil and Argentina. Brazil’s CONAB raised their estimate of Brazilian corn production by 2.5 MMT, so the gap narrowed. For soybeans, USDA lowered their estimate of Brazilian soybean production by 1 MMT while CONAB lowered its estimate of Brazilian soybeans by 0.33 MMT, so that gap shrank a bit also.

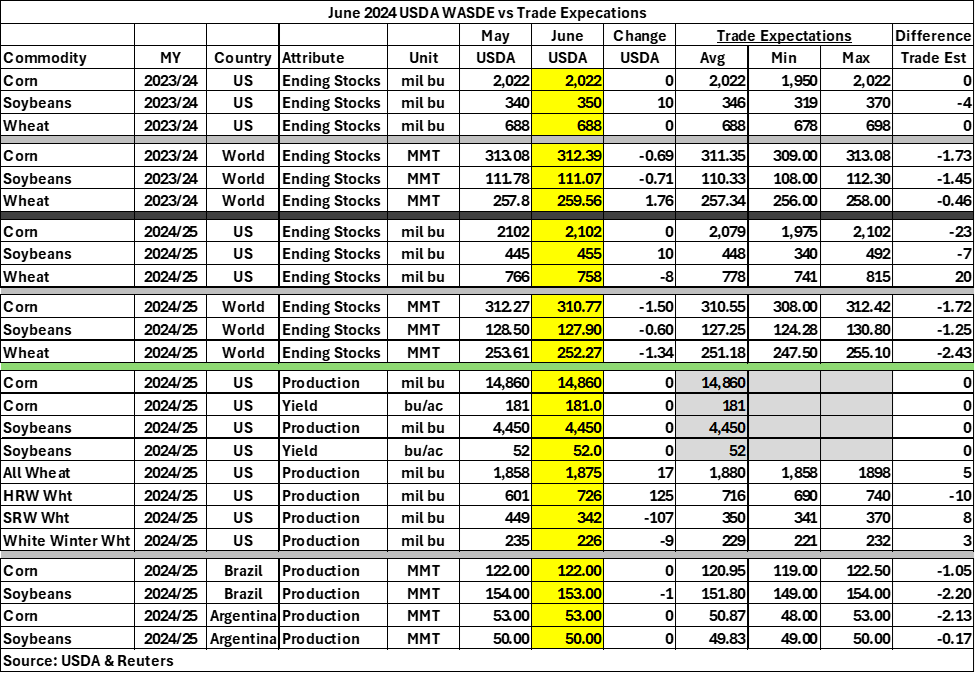

This report brought overall neutral to friendly news to both the corn and soybean markets. Table 1 shows some key report estimates along with trade analyst expectations.

Table 1. June 2024 USDA WASDE vs Market Expectations

Initial Market Reaction

The immediate market reaction to the USDA reports was relatively tepid with little reaction by either the corn or soybean markets. By day’s end however, a little more positive tone was being seen in both the corn, soybean, and soybean meal markets. Corn ended the day up 4 to 5 cents, with soybeans unchanged to a penny lower on the nearby contract. Wheat ended up 4 cents higher. Thursday’s trade was more positive with corn extending the gains from late Wednesday, soybean meal much stronger, and soybeans moving a dime or more higher.

Changes to Domestic Balance Sheets

This section summarizes changes to the corn and soybean balance sheets in more detail.

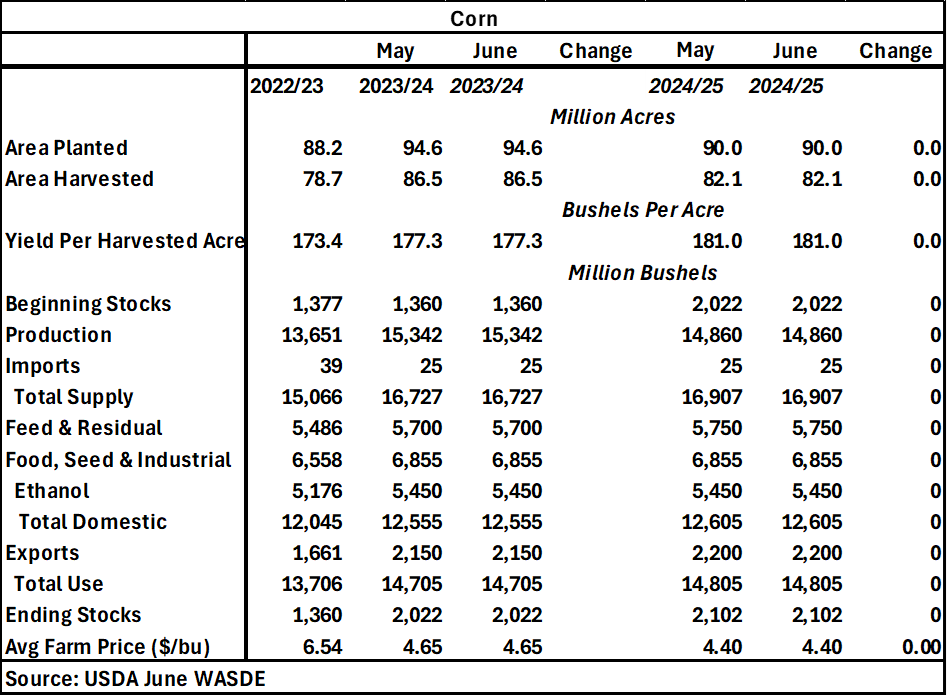

For corn, there were no changes in the WASDE U.S. corn balance sheets for either 2023/24 or 2024/25.

Table 2. June 2024 WASDE Corn Balance Sheet

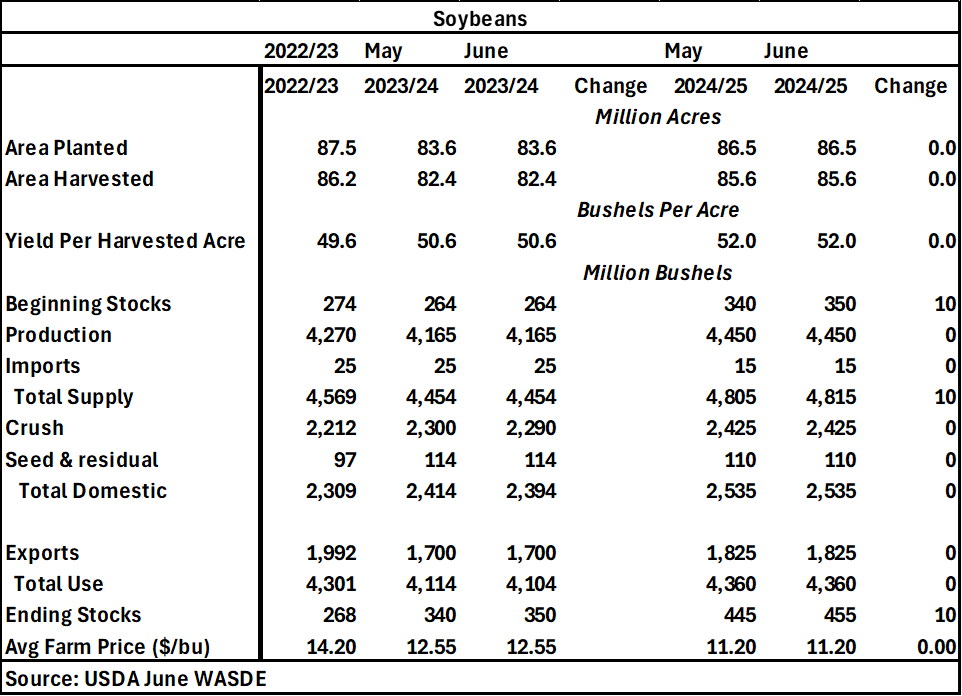

For soybeans, there was a minor change in the 2023/24 balance sheet with crush down 10 million bushels and ending stocks increased by 10 million bushels. For the 2024/25 marketing year, this increased the beginning stocks by 10 million bushels, and this followed through with a 10 million bushel increase in the 2024/25 ending stocks to 455 million bushels. Expected average farm prices for both 2023/24 and 2024/25 were unchanged at $12.55 and $11.20, respectively.

Table 3. June 2024 WASDE Soybean Balance Sheet

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!