June 2023 Supply and Demand Update

Author

Published

6/12/2023

Update Balance Sheets

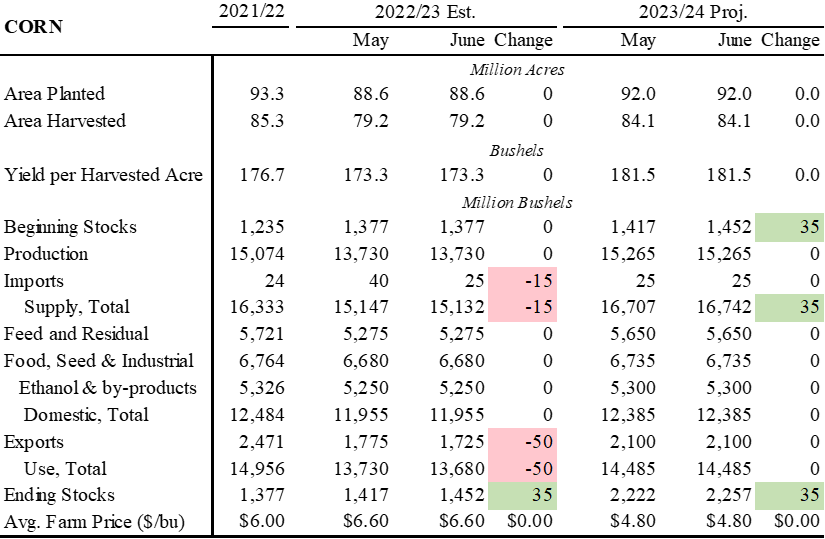

USDA released its June supply and demand projections on June 12, 2023. Changes to supply and use projections were minimal for both corn and soybeans (Table 1 & Table 2). In both instances, no changes were made to the upcoming year’s estimates, and minor changes were made to old crop estimates, exclusively in the import and export categories.

Table 1. WASDE Corn Estimates – June 2023

Table 2. WASDE Soybean Estimates – June 2023

Corn Market

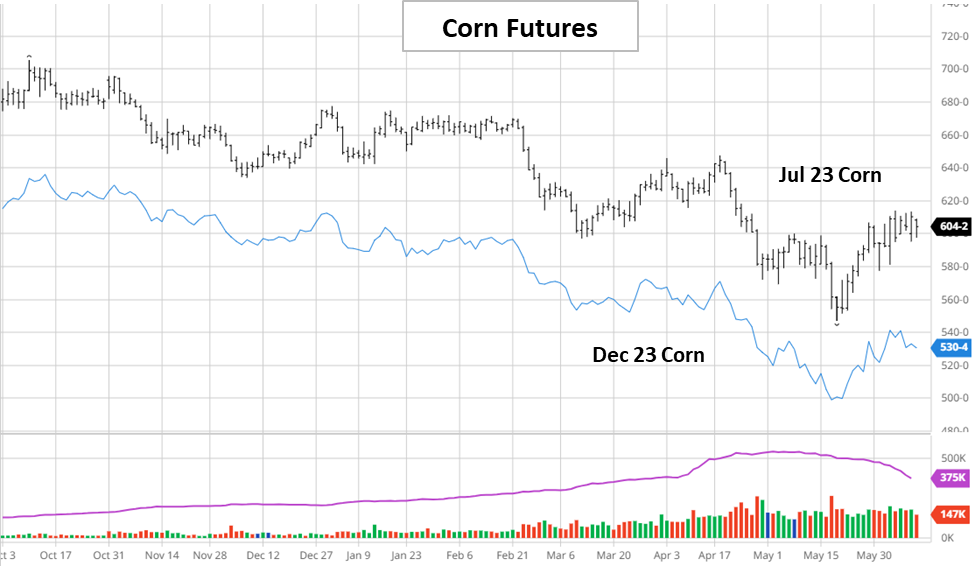

Other than a small rally that started in the middle of May, corn prices have shown a continuous down trend since last October (Figure 1).

Figure 1. Corn Futures; Source: Barchart

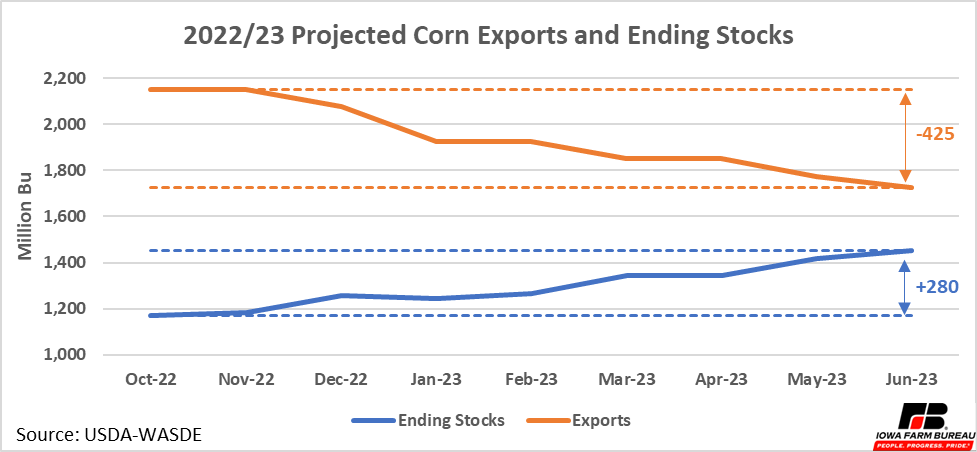

Looking at past WASDE estimates for corn exports and ending stocks, this down trend makes sense. Since last October, expectations for total 2022/23 corn exports have continually decreased (Figure 2). Expected ending stocks have risen by almost the same amount as domestic use cannot absorb all the corn no longer expected to be exported. While corn stocks remain relatively tight, they have become less and less tight over the course of the year, putting downward pressure on the price.

Figure 2. 2022/23 Projected Corn Exports and Ending Stocks

The rally over the past few weeks is linked to the limited rainfall many corn producing areas have seen over the same period. Figure 3 shows combined the past 30-day precipitation as a percentage of normal. Most corn producing areas have been behind normal levels, creating some concern for next year’s crop and putting some upward pressure on prices.

Figure 3. 30-day Accumulated Precipitation Percent of Normal May 13, 2023 – June 11, 2023; Accessed through

Soybean Market

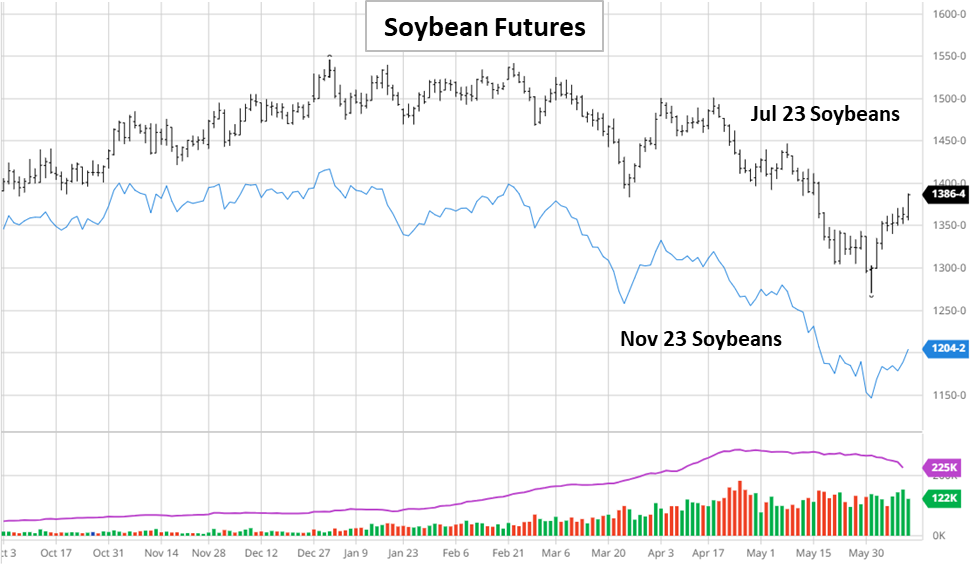

Soybean prices unlike corn were even to higher last fall and earlier this winter but then began to slowly work lower (Figure 4). A recent bounce back over the past few weeks may be partially weather related, similar to corn. However, a large driver has been the recent resurgence in soybean oil prices (Figure 5). After trending down for much of the year, soybean oil prices came up sharply over the last few weeks.

Figure 4. Soybean Futures; Source: Barchart

Figure 5. Soy Complex Futures Percent Change; Source: Barchart

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!