Farm Profits Update and Outlook

Author

Published

5/17/2023

Farm Profits Strong in 2022, Could be Lower in 2023

2022 was an exceptional year for corn and soybean farming, especially in the Midwest. The USDA-ERS estimates average costs and returns for various commodities in multiple regions of the US. Iowa is part of the “heartland” region which also includes Illinois, Indiana, most of Missouri and portions of other adjacent states as well.

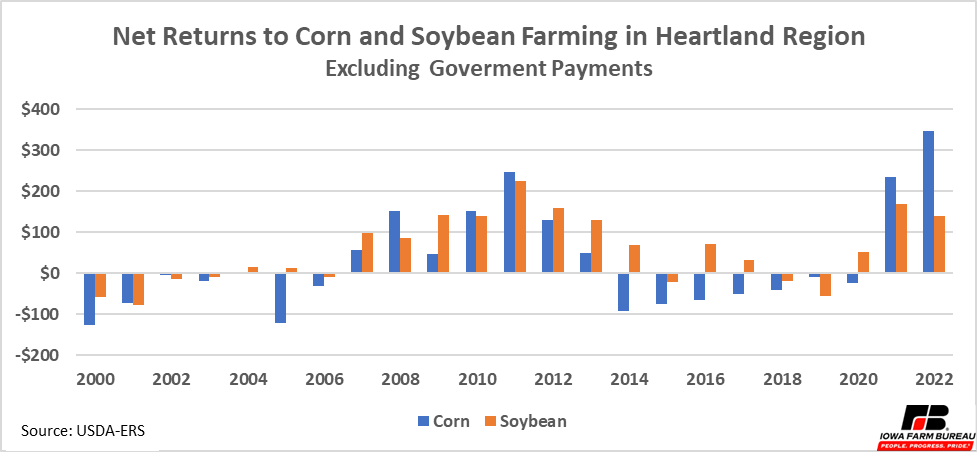

Corn returns in the heartland region were estimated to be $345 per acre. This is the highest estimated returns to corn production in the ERS dataset that goes back to 1996. Soybean returns in the heartland region were $138 per acre. This was down slightly from 2021, but above the long-term average.

Figure 1. Net Returns to Corn and Soybean Farming in Heartland Region

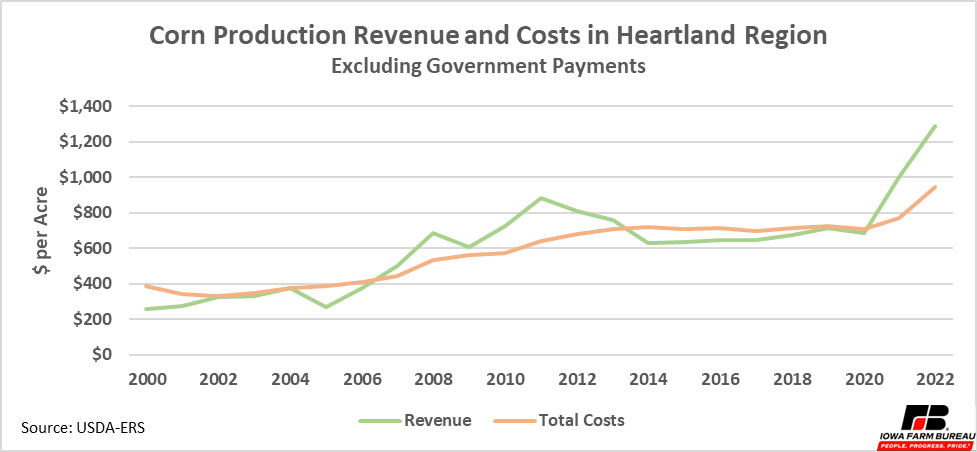

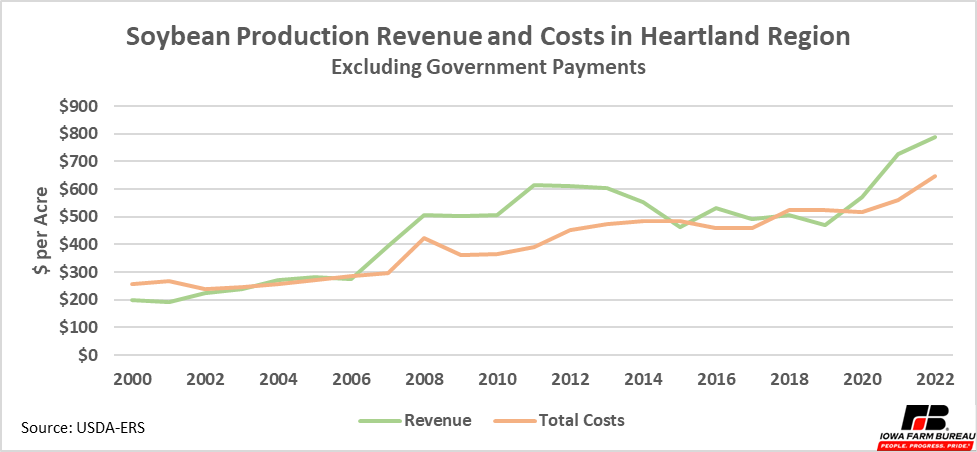

These high returns in 2022 occurred despite record high record input costs. Figure 2 and Figure 3 show annual estimates for total revenue and total costs for heartland region corn and soybean production respectively. Both costs and income have trended up over time, but income has been more volatile than costs for both corn and soybeans. Because income has more volatility than costs, relatively large swings up and down in income are possible while costs steadily increase. This leads to volatility in returns to corn and soybean farming.

Figure 2. Corn Production Revenue and Costs in Heartland Region

Figure 3. Soybean Production Revenue and Costs in Heartland Region

While most crop farmers had excellent years in 2021 and 2022, things could be changing soon. In the same way that upswings in revenue can lead to profitable years, down swings in revenue can lead to rough years, though federal payments through crop insurance or other programs can mitigate losses. Tight supplies of corn and soybeans led to strong revenue years in the early 2010’s and in 2021 and 2022. However, eventually supply catches up to demand, leading to excess supply and lower prices. Notice following the strong returns in the early 2010’s, revenue moved sharply lower in the mid to late 2010’s, which pulled down returns.

Consecutive years of high crop production in the coming years will likely end our current period of tight supplies and push both prices and revenue lower. The USDA projects net farm income will decrease 16% this year compared to last year. This estimate includes all states and commodities but is still relevant to Midwest corn and soybean farming. It will be important to manage margins and make investments now to manage future costs as returns are likely to be lower this year and could be much lower a few years down the road.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!