Crop Insurance Performance in Iowa and U.S.

Author

Published

3/2/2023

The Risk Management Agency of USDA, through private crop insurance companies, offer farmers various crop insurance products for risk management purposes. Crop insurance is a vital tool to help farmers protect their operations from revenue losses and many different types of crop insurance are available.

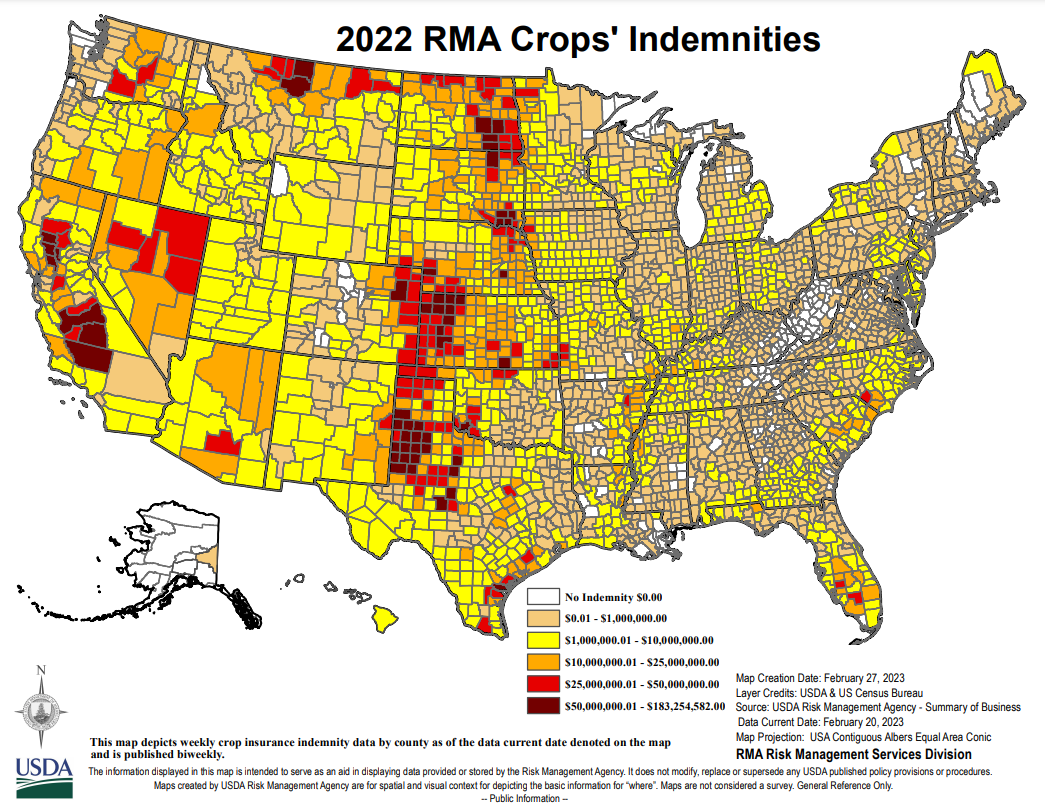

Nationally, farmers pay a portion of the premium to help manage risk on a wide variety of crops. The map below shows the ranges of indemnity (compensation for damages or loss) paid for the crop year 2022 by county:

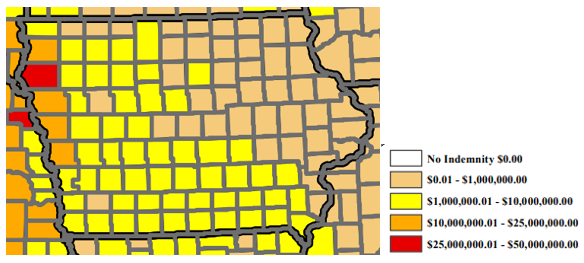

Zeroing in on Iowa (below) the county ranges for 2022 indemnities can be seen more easily:

Iowa coverage and 2023 prices

In Iowa, approximately 90% of corn and soybean acres are generally insured using Revenue Protection (RP) multiple peril crop insurance. These insurance policies can guarantee various levels of a percentage of the farm’s average yield times the higher of the projected price (average futures price in the month of February) or the harvest price (average futures price during the month of October).

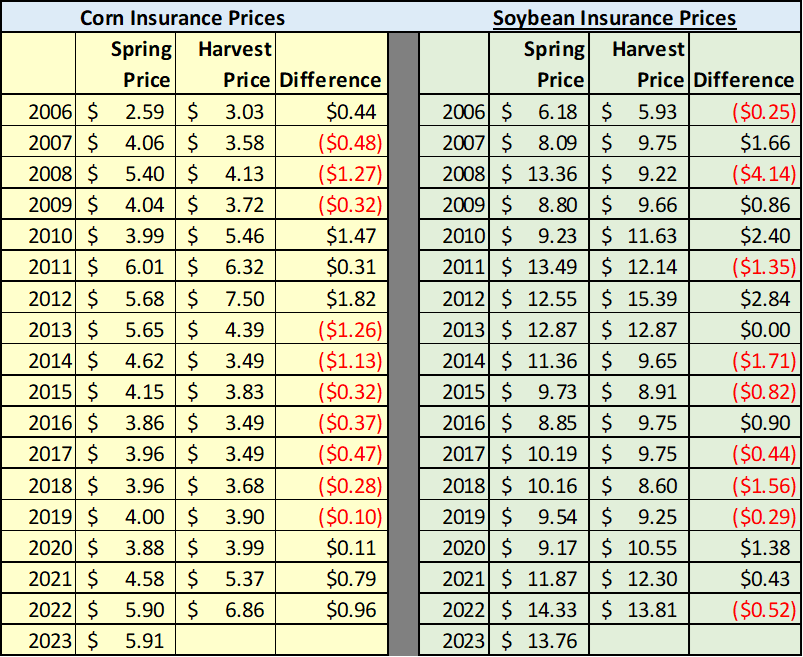

Crop insurance sign-up ends March 15 and the price used in coverage has been set. This year’s spring corn price of $5.91 is just 1¢ per bushel higher than last year. The 2023 spring soybean price is $13.76 which is 57¢ per bushel lower than last year’s record high price. See the graph:

The fall corn price has been higher than the spring price the last 3 years, but prior to that was lower than the spring price the previous 7 years. The fall soybean price has been lower than the spring price in 6 of the last 10 years. With input costs remaining high, the crop insurance decision and these relatively high crop insurance prices will again be important.

Crop Insurance Price History

The prices used in crop insurance policies are set using the new crop futures market. The spring corn price is the average of December corn futures in February; the spring soybean price is the average of November soybean futures in February. The harvest price is the October average of those same new crop futures prices for corn and soybeans. Below is a summary of the crop insurance prices since 2006:

Revenue Protection with Harvest Price Exclusion Example

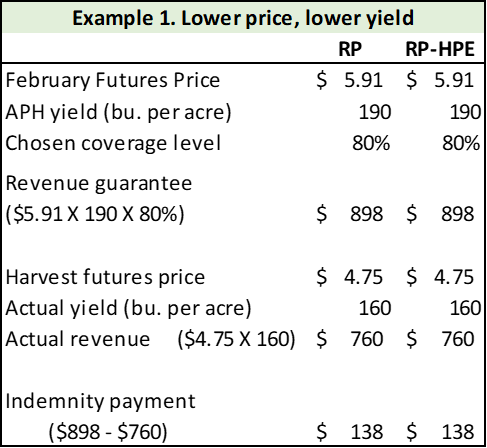

RP-HPE does not adjust the revenue guarantee if the market moves higher from spring to fall. Therefore, the following table calculates the price yield combinations that would result in an insurance indemnity for RP-HPE.

Example: with February futures price at $5.91, APH yield at 190 and c9verave selected at 80%

$5.91 X 190 X 80% = $898 revenue guarantee

Revenue Protection Examples

(Excerpt updated from ISUEO, https://www.extension.iastate.edu/agdm/crops/html/a1-54.html )

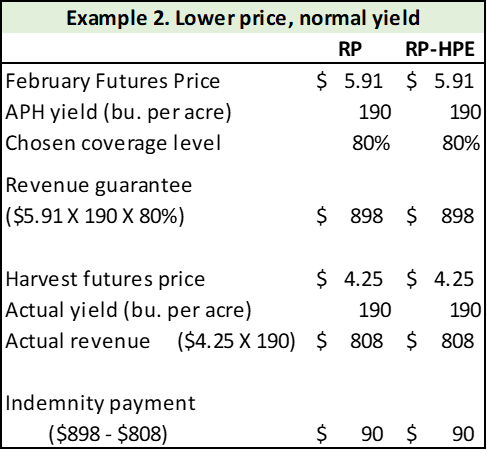

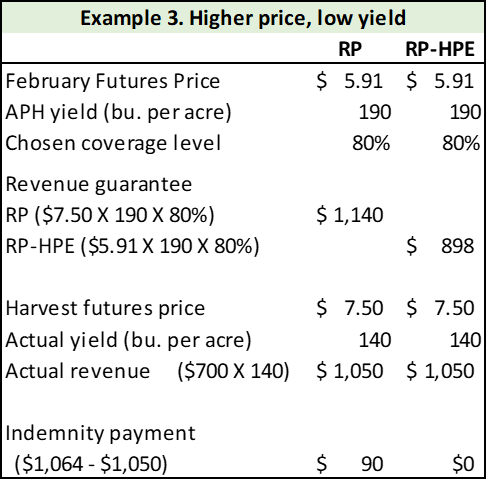

The three examples that follow compare Revenue Protection (RP) and Revenue Protection with with Harvest Price Exclusion (RP-HPE) coverage. The average December corn futures price during February is $5.91. The APH yield is 190 bushels per acre, and the coverage level chosen is 80%. Thus, the revenue guarantee is $898 ($5.91 x 190 bu. x 80%) per acre. Remember that the RP guarantee will increase if the harvest price is higher than the projected price.

In Example 1, the December futures price declines to $4.75 at harvest. The actual yield is only 160 bushels. The estimated actual revenue of $760 is computed by multiplying the harvest price by the actual yield. Subtracting the estimated actual revenue from the revenue guarantee results in an indemnity payment of $138 per acre under either policy type.

In Example 2, the futures price declines to $4.25, lower than in the first example. However, the actual yield is now 190 bushels, equal to the APH yield. Actual revenue is 190 bushels multiplied by the harvest price of $4.25, or $808 per acre. Subtracting the actual revenue from the revenue guarantee results in indemnity payments of $90 for both types of policies. Note that because of the lower harvest prices an indemnity payment was made, even though the actual yield did not fall below the APH yield.

In Example 3, the futures price increases to $7.50 at harvest. Note that the revenue guarantee increases to $1,064 for RP because of the higher harvest price. The actual yield is 140 bushels and the actual revenue is $980. The indemnity payment is $84 for RP, and zero for RP-HPE. There is a payment for RP because of the increase in the revenue guarantee.

The increased coverage when prices increase into harvest is especially useful for producers who normally forward price much of their production before harvest. If they harvest fewer bushels than they forward price, the increased guarantee provides an indemnity payment that will offset the cost of purchasing the deficit bushels at a market price above the price at which they were forward contracted. It is also useful for livestock producers who have to purchase extra grain in a short crop year, often at a high price.

Ed Kordick, Education Project Manager, Decision Innovation Solutions on behalf of Iowa Farm Bureau.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!