Corn Exports Surge in the First Quarter of the Marketing Year

Author

Published

1/29/2025

According to the USDA-Foreign Agriculture Service (FAS) weekly sale data, corn exports from September to December 2024 totaled 630.48 million bushels, significantly surpassing the pace of the same period in 2023 which saw 487.8 million bushels. This near six-year record export quarter was boosted by a weak start to harvest in a major corn export competitor, Brazil.

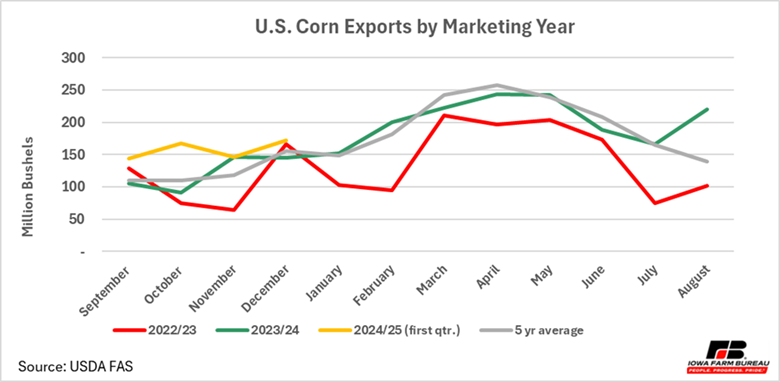

Current weather trends in parts of Brazil indicate that a lack of precipitation could prove to lower yields in some regions of the country, an opportunistic time for the U.S to capitalize on additional export markets which could be proving to be a successful effort at this point in the year. After a relatively successful corn harvest in the U.S., corn exports surged in the first quarter, setting record pace above the 5-year average (Figure 1).

Figure 1: Comparison of U.S. Corn Exports by Marketing Year

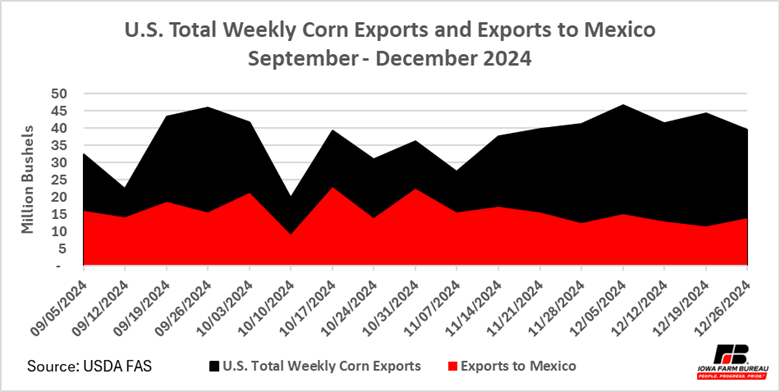

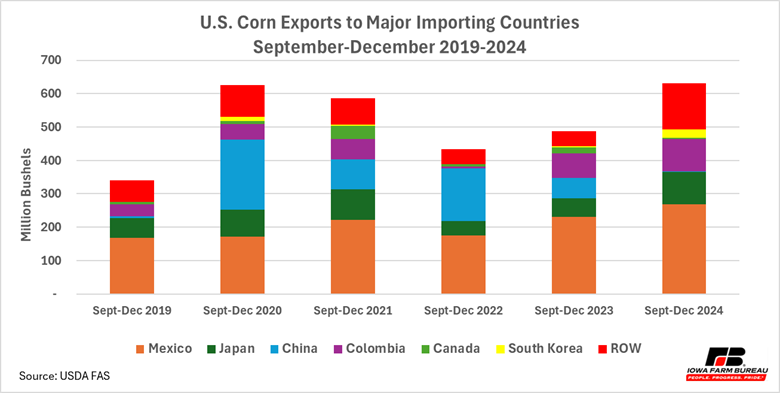

Mexico remained the largest market for U.S. corn exports during the first four months of the marketing year, accounting for 42.5% of total exports, consistent with the previous year’s figures. Exports to Mexico were estimated at 267.9 million bushels (Figures 2 and 3). Mexico’s large volume of imports comes as severe and persistent drought conditions have had significant impacts on corn production.

Figure 2: Total U.S. Corn Exports and Share of Exports to Mexico September-December 2024

Figure 3: U.S. Corn Exports to Major Importing Countries September-December 2019-2024

Exports to Japan totaled 98.2 million bushels from September to December 2024, up from the 54.7 million bushels in 2023. U.S. corn exports to Japan accounted for approximately 16% of the U.S. total corn exports. First quarter exports to Japan were at a 5-year high in 2024/25 weekly export data, a similar trend with exports to South Korea.

China has quickly fallen as a top destination of U.S. corn over time. Exports to China are down significantly from the 61.3 million bushels exported in the first quarter of 2023/24 and 157.1 million bushels in the same period of 2022/23, a 99% decline. China accounted for 13% of total U.S. exports in the first quarter of 2022/23 and accounted for less than 1% in the same period of the current marketing year.

To combat China’s diminishing presence in the market, the U.S. has increased their exports to other markets amid competitive corn prices and high yield projections from South American competitors. The USDA-FAS estimated that exports to Colombia were up to 98.2 million bushels, or around 16% of the U.S total corn exports from the first four marketing months this year. This was a substantial increase from 74.4 million bushels compared to the same period back in 2023.

The December 2024 WASDE report raised total corn exports to 2.475 billion bushels, setting a pace ahead of 2023/24 that projected 2.29 billion bushels; however, the January WASDE report cut exports by 25 million amid lower supply (2.450 billion bushels). The USDA projections on corn exports this marketing year indicate we could see record-setting volumes exported by the end of the year if the current economic climate remains.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!