Beef and Pork Exports Strength Important to U.S. Market.

Author

Published

4/21/2023

Strength of US Beef and Pork Exports

Introduction

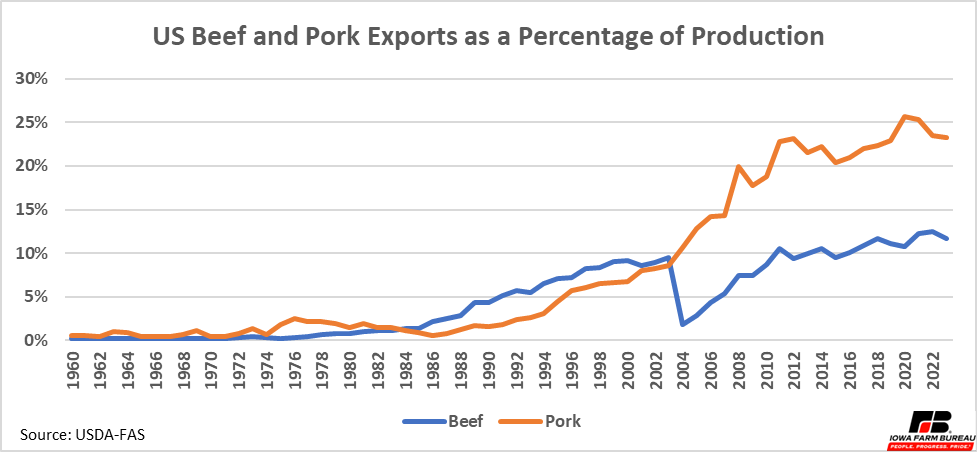

Exports represent a notable percentage of total demand for most major agricultural commodities in the US, including beef (more than 10% of production) and pork (nearly 25% of production) (Figure 1). The US excels at agricultural production and exports allow the US to capture additional value from these products.

Figure 1. US Beef and Pork Exports as a Percentage of Production

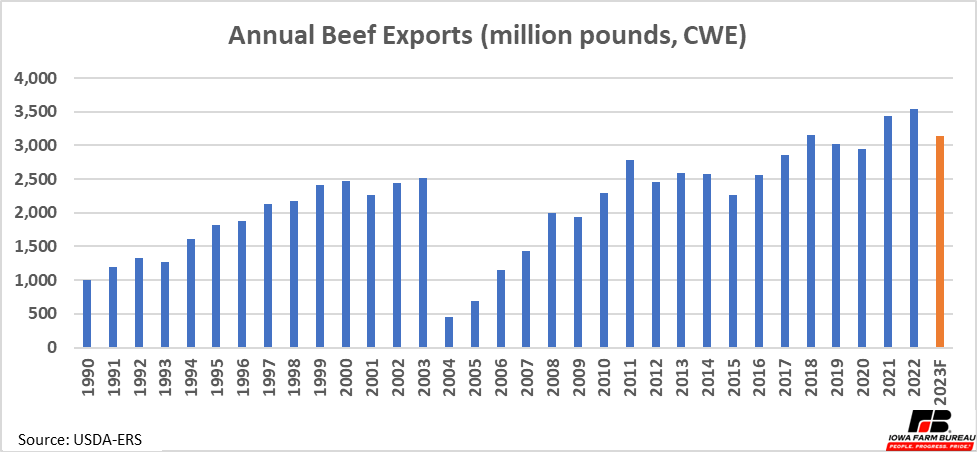

Beef Exports

Annual beef exports over the past two years have been especially strong (Figure 2). Both years set new records of 3.4 billion and 3.5 billion pounds, respectively. This was especially encouraging given the headwinds exports faced in 2022. The US dollar index rose to relatively high levels during the second half of 2022. A strong dollar makes US exports relatively more expensive to other countries. While exports were lower in the second half of the year, the strong dollar did not slow exports enough to prevent the record from being set.

The current WASDE projects beef exports to decrease about 11% relative to last year. A large factor is that the US is projected to produce 5% less beef than last year. The US herd has been contracting since 2020, with 2023 January beef cow inventories totaling 89 million cows, the lowest level since the end of the last contraction cycle in 2013. Total cattle inventories are also tight. Having less animals and total beef available, makes it hard to repeat a strong export year like 2022.

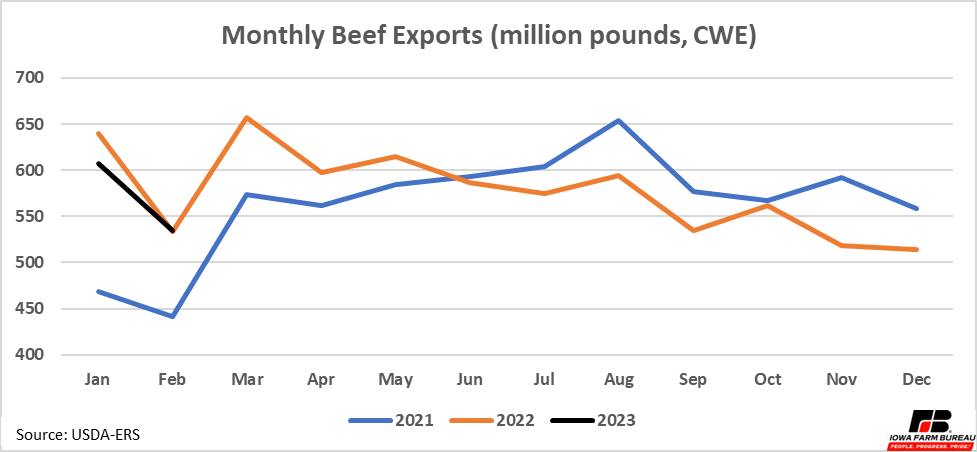

So far in 2023, beef exports are holding in there. Despite higher beef prices exports through February mirror exports in 2022 (Figure 3). Exports are expected to slow down this year and unless domestic demand falters, this likely will happen due to lower production and higher prices. The tighter supply mentioned above will offer support to domestic prices this year, which will eventually deter buyers.

If domestic demand were to falter, it could open the door for lower prices, prompting higher exports. At this point it seems unlikely domestic demand will fall as it has remained strong through the pandemic and our high inflation environment.

Figure 2. Annual Beef Exports (million pounds, carcass weight equivalent)

Figure 3. Monthly Beef Exports (million pounds, carcass weight equivalent)

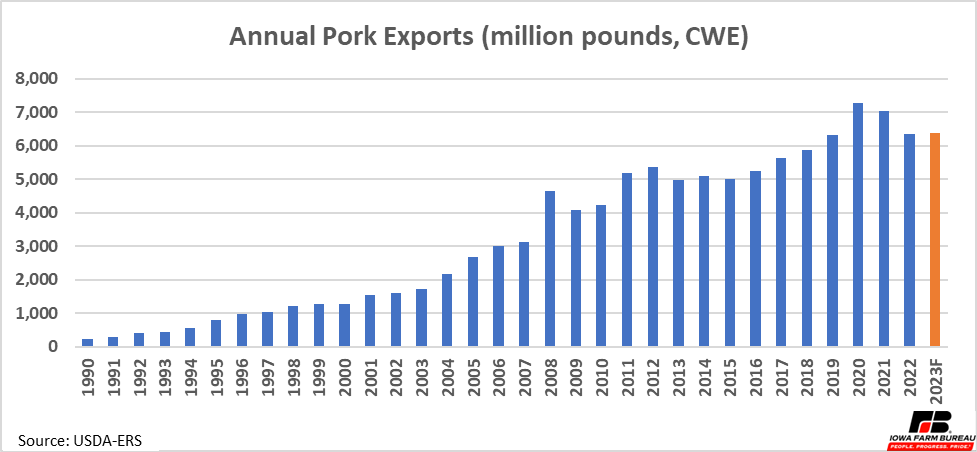

Pork Exports

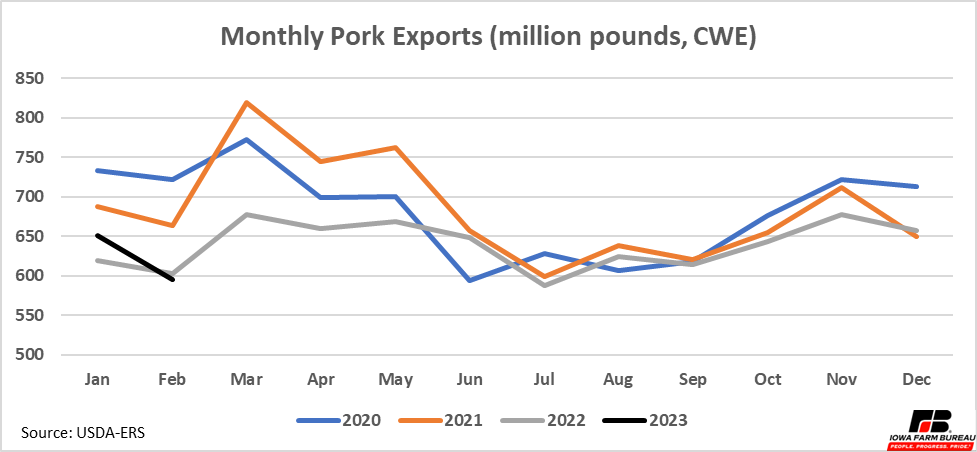

US pork exports have consistently grown over the years and now represent about 25% of total production. US pork exports totaled 6.34 million pounds of pork in 2022 (Figure 4). This is down from records in 2020 and 2021 when China’s domestic production was reduced due to African Swine Fever, and they needed to source more pork from foreign markets. China’s herd has since recovered leading to lower imports of US pork.

So far, pork exports sit about even with last year’s export pace (Figure 5). Given that exports this year are expected to be almost identical to last year’, this is not surprising.

Figure 4. Annual Beef Exports (million pounds, carcass weight equivalent)

Figure 5. Monthly Pork Exports (million pounds, carcass weight equivalent)

Share of World Market

Even with projected drops in beef exports and stagnant pork exports the United States remains a major player in the world meat market.

If projections are realized the US will be the second largest exporter of pork in the world, exporting 27% of world pork exports (Figure 6). Only the EU would rank ahead of the US and this is an aggregate of many countries.

For beef, the US is projected to export 12% of the world’s beef and be the 3rd largest exporter of beef in the world. Brazil has a firm hold on the top spot and India is expected to jump to the number two spot in 2023 as total beef production in the US adjusts downward.

Figure 6. US Share of World Beef and Pork Exports

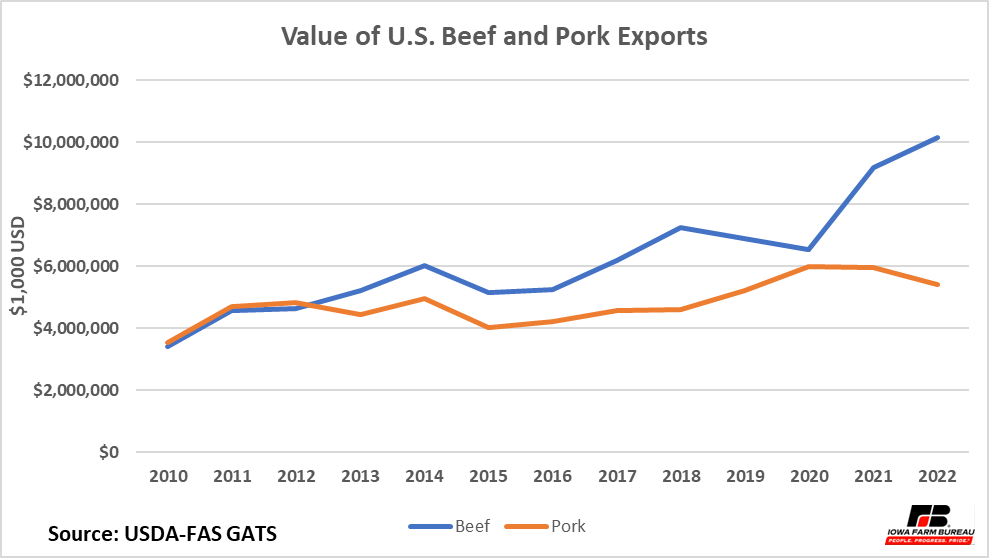

The value of U.S. beef exports reached a new record in 2022, topping $12 billion in value. The value of pork exports dipped a bit in 2022 but is still close to recent high values for U.S. pork exports of $6 billion.

Figure 7. Value of U.S. Beef and Pork Exports

Conclusion

Exports are an important source of demand for US meat products adding nearly $18 billion of value to the beef and pork industries in 2022. The strong dollar and economic uncertainty across the world last year created concerns about US export sales. Beef and pork sales were resilient though, with beef having a record year in 2022 and pork having respectable numbers after losing China as a major buyer.

In 2023, both products look to remain strong in the world market. Pork is expected to have a similar year to last year. Beef exports are expected to be lower this year, but lower domestic supplies, not reduced foreign demand, is expected to be the biggest factor.

Want more news on this topic? Farm Bureau members may subscribe for a free email news service, featuring the farm and rural topics that interest them most!